The Rise of Central Bank Digital Currencies: Opportunities and Challenges

The Rise of Central Bank Digital Currencies: Opportunities and Challenges

Introduction

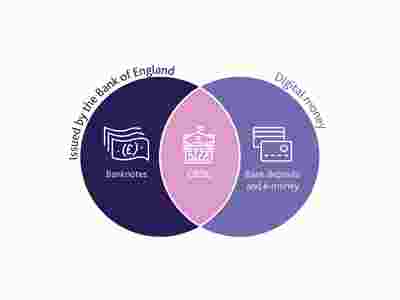

In recent years, there has been a growing interest in the concept of Central Bank Digital Currencies (CBDCs). A CBDC is a digital form of a country’s fiat currency, issued and regulated by its central bank. Several central banks worldwide are exploring the potential benefits and challenges associated with launching their own CBDC. In this article, we will explore the opportunities and challenges that the rise of CBDCs presents.

Opportunities of CBDCs

Enhanced Financial Inclusion

One of the biggest opportunities offered by CBDCs is enhanced financial inclusion. Traditional banking systems often overlook the underserved populations, making it difficult for them to access financial services. With CBDCs, individuals without access to traditional banking can store, transfer, and transact money digitally, empowering them financially.

Efficient Cross-border Transactions

CBDCs have the potential to revolutionize cross-border transactions. Currently, cross-border payments can be slow, costly, and subject to various intermediaries. CBDCs can streamline this process, reducing costs, improving speed, and increasing transparency. This would greatly benefit businesses and individuals involved in international transactions.

Monetary Policy Implementation

Another opportunity offered by CBDCs lies in monetary policy implementation. With a digital currency, central banks can have more control over the money supply, allowing them to implement policies more effectively. CBDCs would enable central banks to distribute funds directly to individuals during times of economic crises, stimulating the economy efficiently.

Challenges of CBDCs

Cybersecurity Risks

With any digital system, there are inherent cybersecurity risks. CBDCs would require robust security measures to protect against hacking, fraud, and theft. Central banks must invest heavily in cybersecurity infrastructure to ensure the safety and trustworthiness of CBDCs.

Privacy Concerns

CBDCs raise concerns about individual privacy. Unlike cash transactions, digital currency transactions can be tracked and monitored. Central banks must strike a balance between transparency and safeguarding individuals’ privacy rights. Implementing strong privacy protections will be crucial to garner public trust in CBDCs.

Technological Challenges

Implementing CBDCs on a national scale presents significant technological challenges. Developing a secure and scalable digital infrastructure, integrating it with existing financial systems, and ensuring interoperability with other CBDCs can be complex and time-consuming. Central banks need to invest in technology and collaborate with industry experts to overcome these challenges effectively.

FAQs about CBDCs

FAQ 1: What is the main difference between CBDCs and cryptocurrencies like Bitcoin?

Answer: Unlike cryptocurrencies, CBDCs are centralized and regulated by a country’s central bank. CBDCs are typically designed to function as a digital representation of a country’s fiat currency, while cryptocurrencies operate independently of any central authority.

FAQ 2: How would CBDCs affect the existing banking system?

Answer: CBDCs could potentially disrupt the existing banking system. As individuals can directly hold and transact with CBDCs, the need for intermediaries like banks may diminish. However, it is more likely that CBDCs will coexist with traditional banking systems, creating new opportunities for collaboration and innovation.

FAQ 3: When can we expect CBDCs to be widely adopted?

Answer: The timeline for the widespread adoption of CBDCs varies across countries. Some central banks, like the People’s Bank of China, are already piloting CBDCs, while others are still in the research and exploration phase. The adoption of CBDCs will depend on various factors, including regulatory frameworks, technological readiness, and public acceptance.

Conclusion

The rise of Central Bank Digital Currencies presents both opportunities and challenges. Enhanced financial inclusion, efficient cross-border transactions, and improved monetary policy implementation are some of the potential benefits. However, cybersecurity risks, privacy concerns, and technological challenges must be overcome. As governments and central banks explore the possibilities, it will be interesting to see how CBDCs shape the future of finance.