RLI Insurance: Ensuring Comprehensive Coverage for Your Home’s Unique Needs

RLI Insurance: Ensuring Comprehensive Coverage for Your Home’s Unique Needs

Why do you need RLI Insurance?

Protect Your Investment

When it comes to homeownership, your house is one of the most significant investments you’ll ever make. Unfortunately, unforeseen events like natural disasters, theft, or accidents can occur and put your investment at risk. This is where RLI Insurance comes in.

Comprehensive Coverage

RLI Insurance is known for its comprehensive coverage options that go beyond the standard policies. They understand that every home is unique, and with their personalized insurance plans, you can ensure that your home and its contents are protected.

What Does RLI Insurance Offer?

Flexible Home Insurance Policies

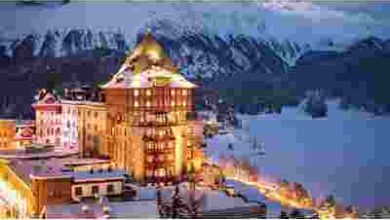

RLI Insurance offers a range of flexible home insurance policies that can be tailored to meet your specific needs. Whether you own a single-family home, condo, or vacation property, RLI has the right coverage options for you.

Additional Coverage Options

Besides the standard coverage for property damage and liability, RLI Insurance provides additional coverage options like:

- Jewelry and Valuable Items Coverage: Protect your precious jewelry and valuable possessions in case of loss or theft.

- Flood Insurance: Safeguard your home against flood damage, even if you don’t live in a designated flood zone.

- Identity Theft Insurance: Get coverage for expenses related to identity theft, such as legal fees or credit monitoring services.

- Home Business Coverage: Ensure that your home-based business is protected against any potential risks.

FAQs about RLI Insurance

1. How do I get a quote for RLI Insurance?

To get a quote for RLI Insurance, you can visit their website and fill out the online form. Alternatively, you can also contact a local agent who can guide you through the process and help you find the best coverage options for your home.

2. Can RLI Insurance cover my vacation home?

Absolutely! RLI Insurance offers coverage options specifically designed for vacation homes. Whether you’re using the property as a second home or renting it out, RLI Insurance has the right policy for you.

3. What if I already have homeowner’s insurance?

If you already have homeowner’s insurance, it’s still worth considering RLI Insurance for their additional coverage options. You can choose to add specific coverage to your existing policy or even switch to RLI Insurance for a more comprehensive and tailored coverage.

Conclusion

Your home is more than just a building; it’s your sanctuary and your investment. Protecting it with RLI Insurance ensures that you have comprehensive coverage that goes beyond the standard policies. With flexible options and additional coverages to choose from, RLI Insurance is the perfect choice to safeguard your unique home and its needs.